Understanding SBA 504 Loans

The Small Business Administration (SBA) 504 Loan is a powerful tool for small businesses seeking long-term, fixed-rate financing for major assets like real estate and equipment. Understanding the specifics of this loan type is crucial for successful application and utilization.

Benefits of SBA 504 Loans

SBA 504 Loans offer numerous advantages, including low down payments, long-term fixed rates, and the ability to finance project costs. These benefits make the 504 Loan an attractive option for small business owners aiming to expand or upgrade their operations.

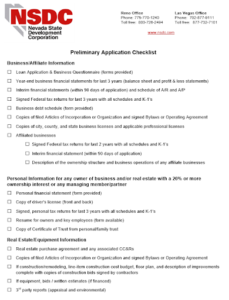

Essential Documents for SBA 504 Loan

To apply for an SBA 504 Loan, specific documents are required to assess your business’s eligibility and financial health.

Business Financial Statements

These documents provide a snapshot of your business’s financial status, including balance sheets, income statements, aging account receivables, aging account payables, and cash flow statements. They are essential for lenders to understand the financial standing of your business.

Personal Financial Records

Your personal financial history plays a significant role in the loan approval process. Documents like personal tax returns and credit reports are typically required.

Legal Documents

Legal documents, such as articles of incorporation, business licenses, and contracts, are necessary to verify the legal standing and structure of your business.

The Application Process

The application process for an SBA 504 Loan can be intricate and requires careful preparation.

Steps to Apply for an SBA 504 Loan

To apply for a loan, it’s best to contact one of loan experts to help you with the application: Contact Us

We will discuss your business and your financing needs, make an appointment or mail you the appropriate application. You can get a head start in the process by gathering historical financial information on the business and business owner(s) as well as a summary of your project or financing needs using our application forms.

Tips for a Successful Application

Providing accurate and comprehensive documentation, maintaining good credit, and presenting a strong business plan can significantly enhance your chances of approval.

Credit History Requirements

Your credit history is a vital component of the loan approval process.

Understanding Your Credit Score

A good credit score can improve your chances of loan approval. It’s important to know your score and understand how it’s calculated.

Improving Your Credit for Loan Approval

Strategies to improve your credit score include paying bills on time, reducing debt, and correcting any errors on your credit report.

Business Plan Essentials

A well-crafted business plan is essential for loan approval, as it demonstrates the viability and potential of your business.

Crafting a Strong Business Plan

Your business plan should include detailed information about your business model, market analysis, management team, and financial projections.

How a Business Plan Affects Your Loan Application

A robust business plan can convince lenders of your business’s potential for success and ability to repay the loan.

Collateral Requirements

Most SBA 504 Loans require collateral, typically in the form of the assets being financed.

Types of Collateral Accepted

Collateral can include real estate, equipment, or other business assets. Understanding what can be used as collateral is important for your loan application.

Preparing Your Collateral Documents

Ensure all documents related to your collateral are accurate and readily available. This includes titles, deeds, and appraisals.

Importance of Legal Documents

Legal documentation is crucial for validating the legal status and compliance of your business.

List of Legal Documents Required

Typical legal documents include articles of incorporation, partnership agreements, and business licenses.

How to Obtain Necessary Legal Documents

If you’re unsure about any legal documents, consult with a legal professional to ensure you have everything in order.

Financial Projections and Statements

Lenders use financial projections and statements to assess the future financial health of your business.

Preparing Financial Projections

Your financial projections should be realistic and based on sound assumptions. They should include projected income statements, balance sheets, and cash flow statements.

Importance of Accurate Financial Statements

Accurate financial statements are crucial for lenders to gauge the current financial health of your business.

Role of Personal Financial Records

Personal financial records provide lenders with insight into your personal financial responsibility and stability.

Personal Financial Statement Overview

A personal financial statement outlines your personal assets, liabilities, and net worth. This document is often required for loan approval.

How Personal Finances Affect Loan Approval

Your personal financial history can impact your business loan approval. Lenders consider factors like personal credit history and personal debt-to-income ratio.

Tax Documents and Their Importance

Tax documents are critical for verifying the financial history of both you and your business.

Types of Tax Documents Needed

Common tax documents include personal and business tax returns, W-2s, and 1099s.

Organizing Your Tax Documents

Having your tax documents organized and readily available can speed up the loan application process.

Additional Supporting Documents

Depending on your business type and the specifics of your loan application, additional documentation may be required.

Additional Documentation for Specific Cases

Additional documents can include franchise agreements, lease agreements, and proof of insurance.

How to Prepare Additional Supporting Documents

Ensure that all additional documents are current, accurate, and complete.

Conclusion

Applying for an SBA 504 Loan involves a thorough preparation of various documents. Understanding and organizing these documents can greatly enhance your chances of a successful loan application.